Tax groups determining algorithm

This algorithm is used to define the tax group specified in a fiscal device print of a sale, invoice or payment document.

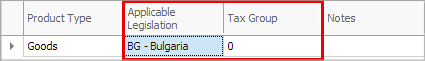

When we sell a product both in and outside of Bulgaria, in the product settings, the tax group in the product type must be 0 (zero).

That gives us 2 options to define the tax group in the Sales Order depending on the country where the product will be delivered:

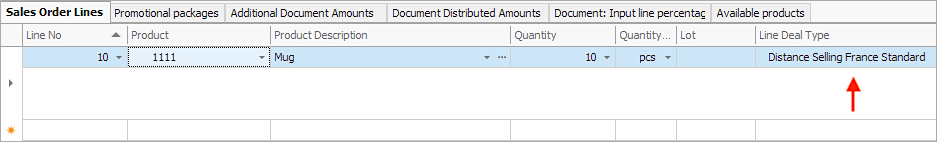

In the Sales order lines in the Line deal type field for sales/deliveries in Bulgaria, we can apply groups from 1 to 4;

In the Sales order lines in the Line deal type field for sales/deliveries outside of Bulgaria, which require the issuance of a fiscal receipt, we can apply group 1.

How it works

The final tax group is set to depend not only on the tax group of the product type (default), but on the deal type specified in the sales lines.

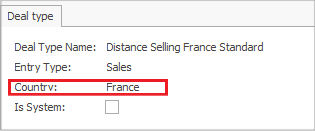

To actually apply the effects of the algorithm, you need to configure the deal type's TaxCode field.

As a result, one and the same product can now be assigned a foreign or a national tax group in accordance with the location its sale has been made in.

Specifics

There are four scenarios you may stumble upon while using the tax group defining algorithm.

- When the product type has a tax group equal to zero (0), the tax group is based on the TaxCode field of the deal type.

Make use of the following code:

IF Product.ProductType.TaxGroups.TaxGroup (Where ApplicableLegislation = 'BG') <> 0

THEN taxGroup = Product.ProductType.TaxGroups.TaxGroup (Where ApplicableLegislation = 'BG')

- When the product type has a tax group different from zero and the applicable legislation is ''BG'', the tax group is going to be the same tax group.

Use the code:

IF Product.ProductType.TaxGroups.TaxGroup (Where ApplicableLegislation = 'BG') = 0

AND LineDealType.Country = 'BG'

THEN

- When the product type has a tax group equal to zero and the applicable legislation is ''BG'', the tax group is defined by the tax code of the deal type.

Use the following scheme:

IF LineDealType.TaxCode = "STD" THEN taxGroup = 2

IF LineDealType.TaxCode = "RED" THEN taxGroup = 4

IF LineDealType.TaxCode = "SPR" THEN taxGroup = 1

IF LineDealType.TaxCode = "INT" THEN taxGroup = 1

IF LineDealType.TaxCode = "EXM" THEN taxGroup = 1

IF LineDealType.TaxCode = "NS" THEN taxGroup = 1

In the previous three cases, expect a rate to be printed in accordance with the Bulgarian legislation.

IF Product.ProductType.TaxGroups.TaxGroup (Where ApplicableLegislation = 'BG') = 0

AND LineDealType.Country <> 'BG'

THEN

- When the product type has a tax group equal to zero, the applicable legislation is ''BG'' and the country specified in the deal type of the sale lines is different from ''BG'', the tax group is once again based on the tax code of the deal type.

However, the scheme is different:

IF LineDealType.TaxCode = "STD" THEN taxGroup = 1

IF LineDealType.TaxCode = "RED" THEN taxGroup = 1

IF LineDealType.TaxCode = "SPR" THEN taxGroup = 1

IF LineDealType.TaxCode = "INT" THEN taxGroup = 1

IF LineDealType.TaxCode = "EXM" THEN taxGroup = 1

IF LineDealType.TaxCode = "NS" THEN taxGroup = 1

In this scenario, expect a document to be printed for tax group 1 - export.